Equity in Times of Austerity: Ontario’s Revenue Crisis in Historical Perspective

Mots-clés :

health equity, austerityRésumé

Concerns for health equity have found entry into social policy discussions in Canada at both the national and provincial levels of government. However, in the aftermath of the global financial crisis social programs improving the distribution of social determinants of health (SDHs), such as adequate housing and income, secure employment opportunities, affordable education and health care are increasingly under attack. In light of persistent deficits, historically high debt, and the precarious state of the global economy, there is a need to re-examine various revenue tools as, to date, there has been little historical analysis of the structural changes made to revenue sources or acknowledgment of the need to re-examine the revenue side of government activity in addressing fiscal imbalances. The article interrogates changes to the Ontario taxation system, especially during the deepening of neoliberal policies in the province (post 1990), to provide historical context to the current state of the provincial treasury. It focuses particularly on income, sales, and corporate income tax, which comprise the majority of revenue generated through taxation. The decline in government revenue is then linked to three key pathways affecting the distribution of social determinants of health: social assistance, labour market policy, and housing. The article finally probes the plausibility of alternative tax structure scenarios and their potential for financing social programs that address health equity.

Résumé

Une préoccupation pour l’équité en matière de santé a été incorporée aux discussions de politiques sociales, tant au niveau provinciale que fédérale. Cependant, suivant la crise financière globale, l’amélioration d’une distribution plus équitable des déterminants sociaux de la santé par des programmes d’aide sociale, comme un logement et un revenu approprié, la sécurité d’emploi, une éducation et des soins de santé accessibles, sont chaque jours plus menacés. Considérant les déficits constants, un historique de dette élevée, ainsi que l’état précaire de l’économie globale, il existe un réel besoin de réexaminer différents outils du revenu. À date, il n’y a eu que très peu d’analyses historiques des changements structuraux qui ont été apportés aux sources de revenus, et même, de la nécessité de réexaminer le côté revenu de l’activité gouvernementale lorsqu’ on aborde le déséquilibre budgétaire. Cet article interroge les changements apportés au système de taxation de l’Ontario, surtout lors de l’approfondissement des politiques néolibérales (après 1990), afin d’offrir une analyse historique de l’état actuel de la trésorerie provinciale. L’article examine plus particulièrement les taxes sur le revenu, les ventes, et sur la fiscalité des sociétés, ce qui comprend la vaste majorité des revenus obtenus à travers la taxation. La baisse de revenus gouvernementaux est reliée avec trois voies majeures affectant la distribution des déterminants sociaux de la santé: l’assistance sociale, la politique du marché du travail, et le logement. Finalement, des structures de taxes alternatives sont examinées, ainsi que leur plausibilité et leur potentiel pour financer des programmes d’assistance sociale qui traitera de l’équité en matière de santé.

Mots-clefs: équité en matière de santé; austérité

Téléchargements

Publié-e

Comment citer

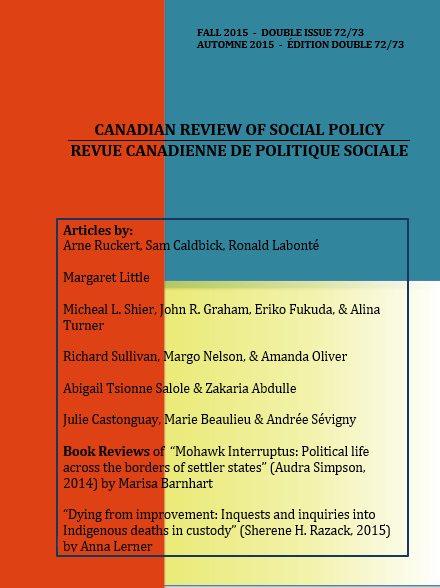

Numéro

Rubrique

Licence

1-The author guarantees that the manuscript is an original work not published elsewhere in print or electronically in whole or in part, except in abstract form, that the author has the full power to make this contribution, and that the manuscript contains no matter libelous or otherwise unlawful or which invades the right of privacy or which infringes any proprietary right.

2-The author guarantees that the manuscript has not been previously published in print or electronically and that if the manuscript contains any tables, figures or images fully reproduced or closely adapted from previously published material, the author must obtain the necessary permission from the author/publisher holding the original copyright prior to publication in CRSP. The author may be required to produce evidence of permission granted to CRSP’s editors.

3-As a condition of publication in CRSP, the author assigns all copyright to CRSP, including but not limited to the right to publish, republish, and otherwise distribute this manuscript in print, electronic, or other formats. As CRSP is a non-profit interdisciplinary scholarly journal, the author will receive no royalty or other monetary compensation for the assignment set forth in this agreement.

For the purpose of full disclosure, CRSP will not normally use the content provided by the author in a commercial venture, but for the purpose of disseminating the author’s content to as many readers as possible. For distribution, third parties engaging in commercial activities may be contracted to distribute the content globally, and such parties may make a profit out of the author’s content in their normal course of business. CRSP will not pay the author or reimburse the author in any form based on such commercial activities because the conduct of such commercial activities is outside the control of CRSP.

Any future reference to or use of this published material by the authors must acknowledge CRSP as the original place of publication.

PERMISSION REQUEST/ARCHIVING

Permission is given to author(s) receiving funding via Tri-Council Agencies, the Canadian Institutes of Health Research (CIHR), the Natural Sciences and Engineering Research Council of Canada (NSERC) and the Social Sciences and Humanities Research Council (SSHRC), to make their publications freely available in an Open Access repository within the stated deadline by the Tri-Council Agencies (12 months following publication). Archiving of publication must be a manuscript copy bearing none of the CRSP headers, footers or any other distinguishing marks. No links to the article on the CRSP website is permitted.

Permission requests from third parties to reproduce articles in part or full in academic/educational publications can be directed to the managing editor of CRSP, and will not be unreasonably denied.